Can Wedding Planners Actually Save You Money?

Planning a wedding feels exciting… until the budget starts growing faster than expected. Many couples ask the same question: Will hiring a wedding planner actually help me save money, or is it just another expense? The truth is — it depends on how you use one. This guide breaks everything down in a simple, honest way so you can see where real savings happen, where they don’t, and how to protect your budget from day one.

1. Calculate Total Wedding Budget

Before hiring anyone, know your full number. Many couples guess and later panic when costs stack up. A clear total budget gives your planner boundaries and helps prevent overspending. Think of it as your financial map — without it, every decision becomes emotional instead of practical.

- List total savings available

- Add family contributions honestly

- Set a max spending limit

- Reserve 10–15% for surprises

- Separate must-haves from nice extras

Quick insight: Start with real numbers, not wishful ones.

Small reason this helps: Clear limits guide smarter choices.

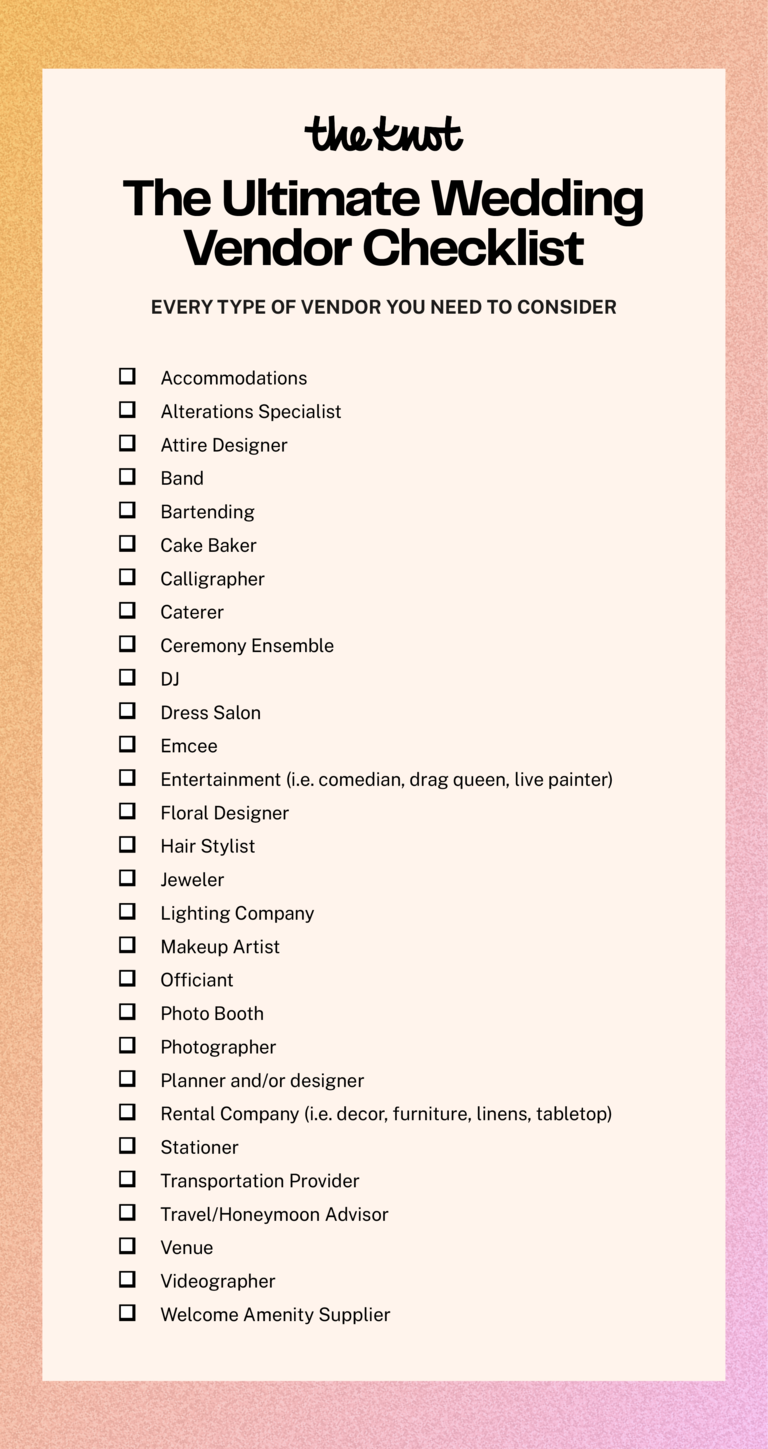

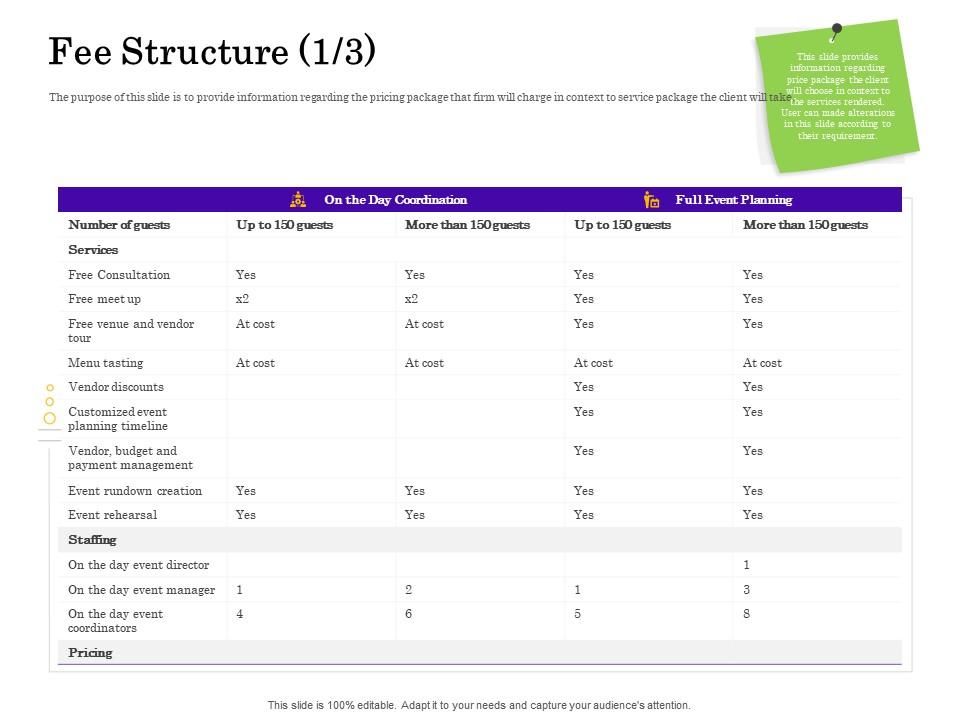

2. Break Down Service Package Tiers

![]()

Not every planner offers the same service. Some handle only the final month, while others manage everything from day one. Understanding package levels helps you avoid paying for services you don’t need. Choosing the right tier can create savings without losing support.

- Day-of coordination for simple weddings

- Partial planning for vendor support

- Full planning for complex events

- Ask what is NOT included

- Compare time vs value

Extra guidance: Pick help based on stress level, not trends.

Why it pays off: Matching needs avoids wasted spending.

3. Track Hidden Vendor Fees

Hidden fees are where budgets quietly explode. Delivery charges, setup fees, overtime costs, and service taxes often appear late. A good planner spots these early. Even if you DIY, learning to track them saves money immediately.

- Ask vendors for full cost breakdown

- Confirm overtime pricing

- Check delivery and setup charges

- Ask about cancellation penalties

- Review tax and service percentages

Smart move: Always ask for final total, not base price.

Why it matters: Transparency prevents last-minute shocks.

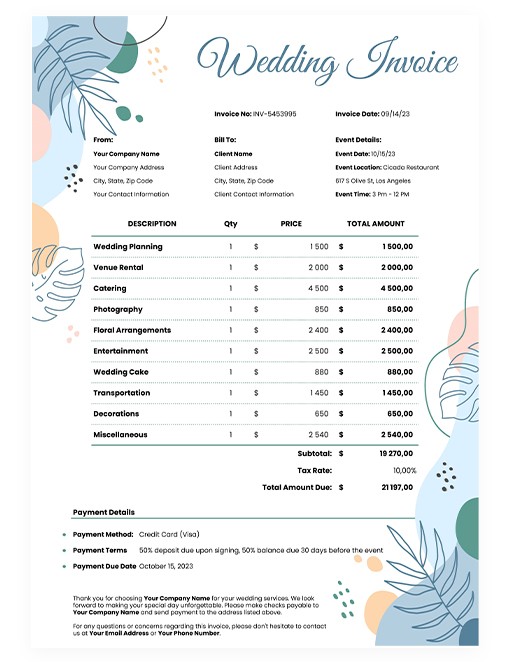

4. Compare Planner Pricing Structures

Planners charge in different ways: flat fee, percentage of budget, or hourly. Each has pros and cons. A percentage model can grow as you spend more, while a flat fee keeps things predictable. Understanding this early helps you decide if the planner truly saves money.

- Flat fee = predictable cost

- Percentage fee = flexible but grows

- Hourly billing suits small weddings

- Ask for example invoices

- Clarify revisions and extra calls

Helpful reminder: Compare total value, not just price tag.

Why this is effective: Clear payment structure avoids confusion later.

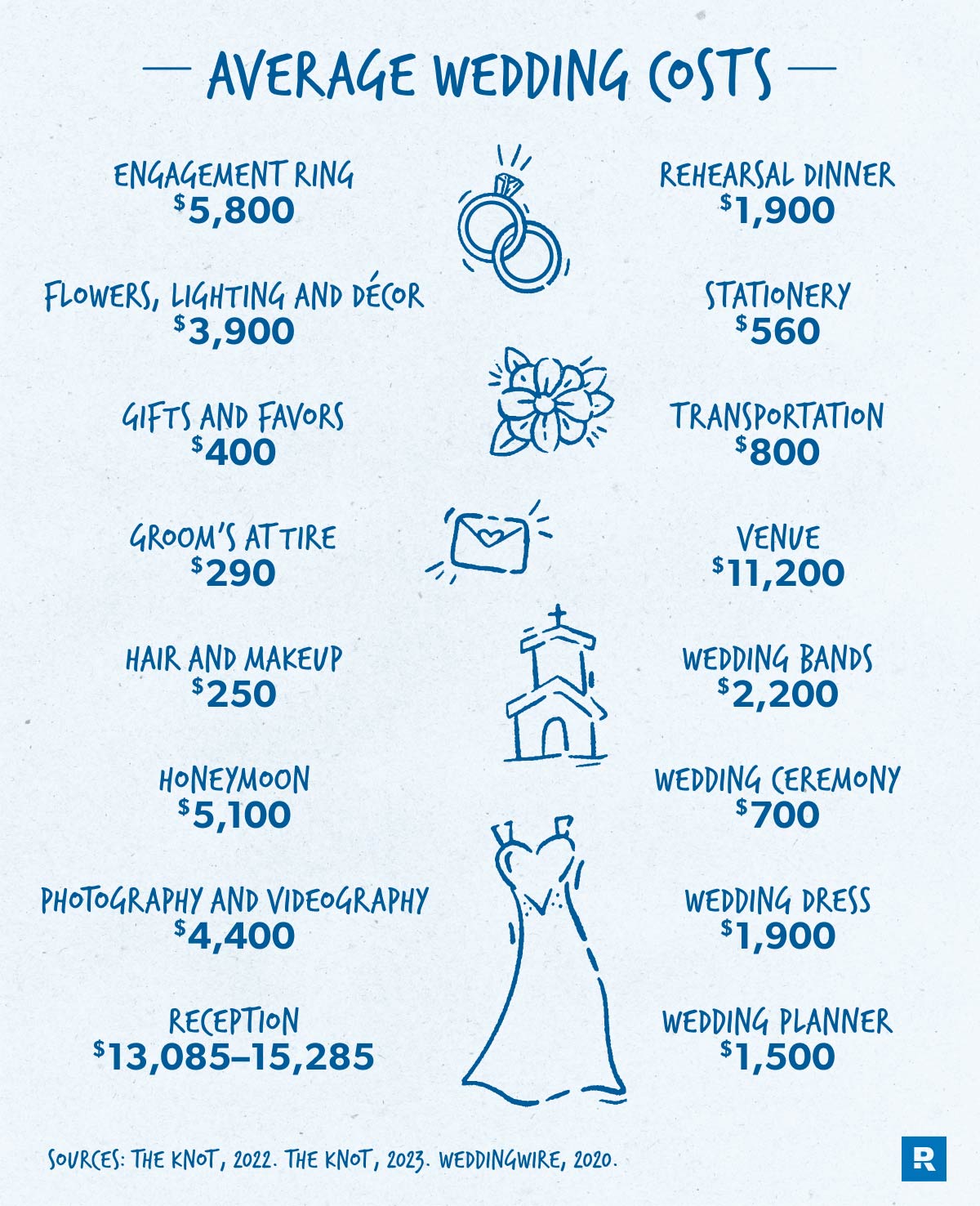

5. Review Bundled Vendor Discounts

![]()

Many planners have strong vendor relationships. They sometimes secure discounts or bonus services. That’s often where real savings appear. If you’re exploring a planner guide, ask planners directly how they reduce costs through partnerships instead of guessing.

- Ask about preferred vendor rates

- Check if discounts are passed to you

- Compare prices with market averages

- See what extras are included

- Confirm quality, not just price

Extra note: Savings work only with trusted vendors.

Reason it works: Relationships reduce negotiation stress and cost.

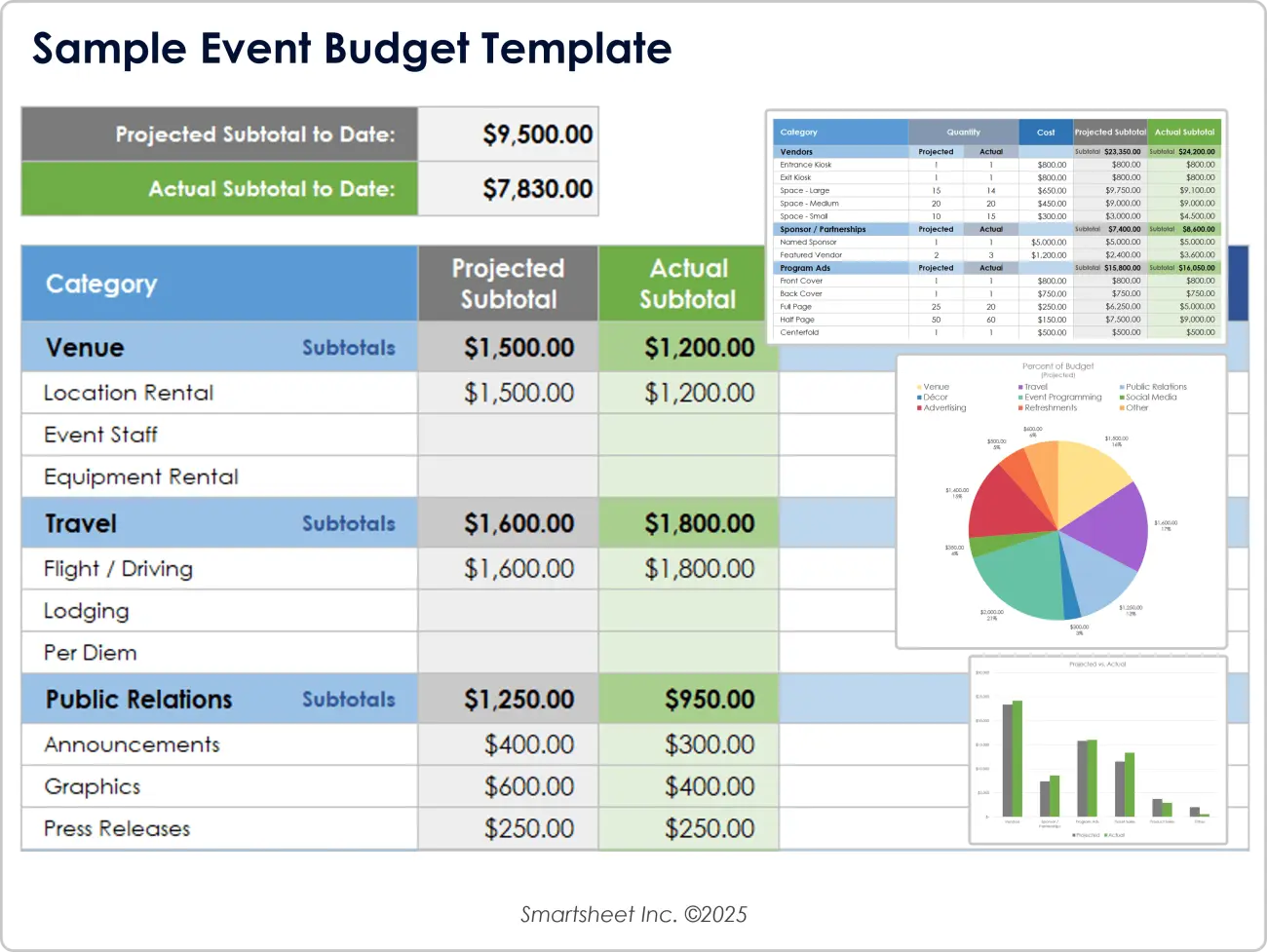

6. Calculate Return on Investment

Think beyond money spent. A planner might save hours, stress, and costly mistakes. Calculate ROI by comparing planner fee versus potential vendor savings and avoided errors. Sometimes peace of mind itself has value.

- Compare planner cost vs discounts gained

- Add estimated time saved

- Include avoided penalty fees

- Measure stress reduction realistically

- Look at decision efficiency

Small reminder: ROI isn’t only about cash.

Why this angle helps: It shows the bigger financial picture.

7. Avoid Last-Minute Surprise Fees

Late changes often cost the most. Rush printing, overtime vendors, and emergency rentals can destroy a budget. Planners usually prevent this by building structured timelines.

- Confirm guest count early

- Freeze decor choices sooner

- Finalize timeline in advance

- Avoid late vendor swaps

- Double-check contract deadlines

Tiny adjustment: Decide early whenever possible.

Why this saves money: Last-minute choices are always expensive.

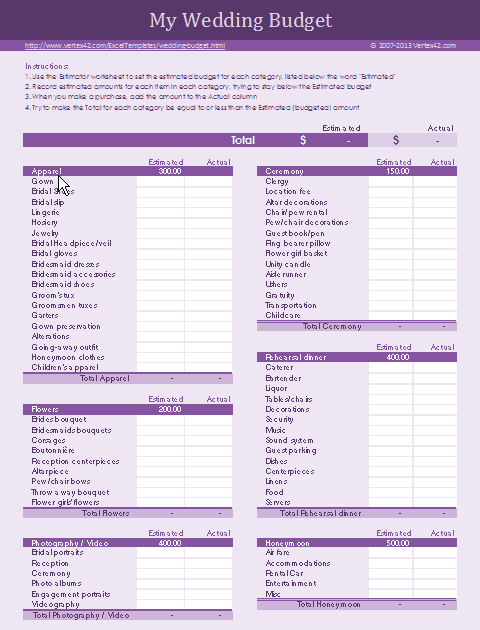

8. Compare DIY vs Planner Savings

![]()

DIY feels cheaper at first, but hidden costs appear fast — time, stress, rental mistakes, or buying tools you’ll never use again. Some couples save more by mixing DIY decor with planner coordination. For styling inspiration, you can explore budget decor ideas while keeping costs practical.

- DIY suits small guest lists

- Planner helps with complex logistics

- Compare actual time investment

- Include transportation costs

- Think about setup help needed

Friendly suggestion: Hybrid planning often works best.

Reason behind it: You control costs without losing support.

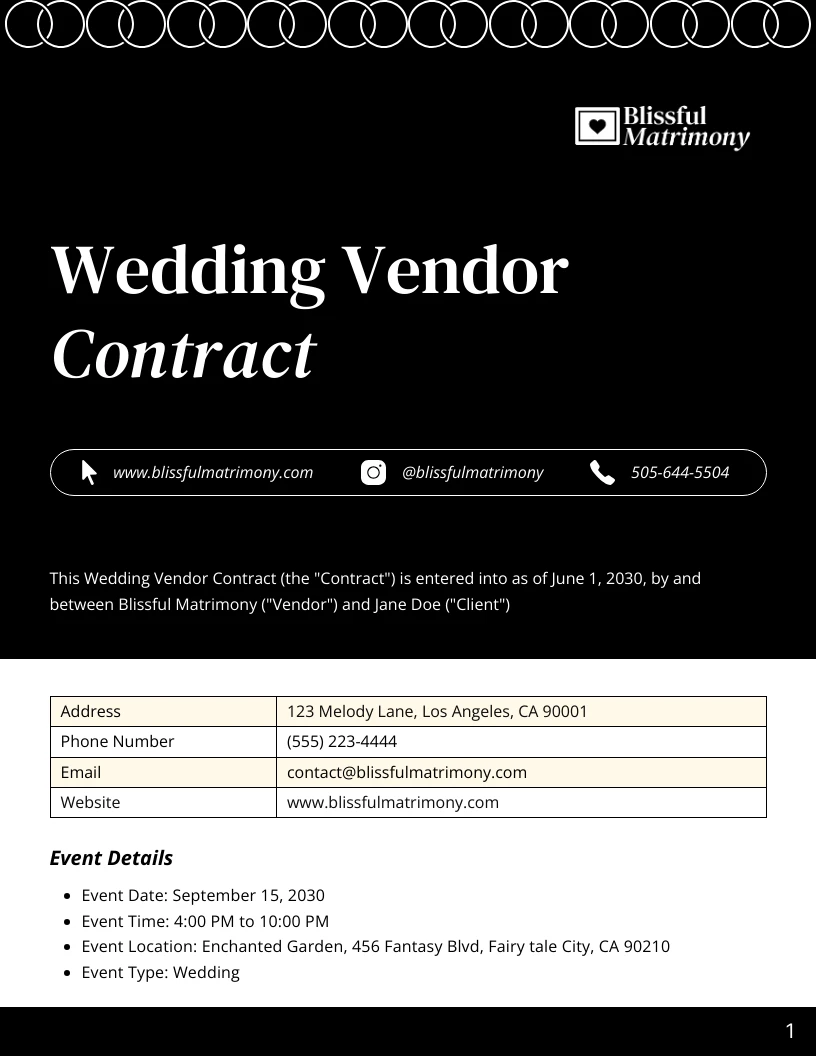

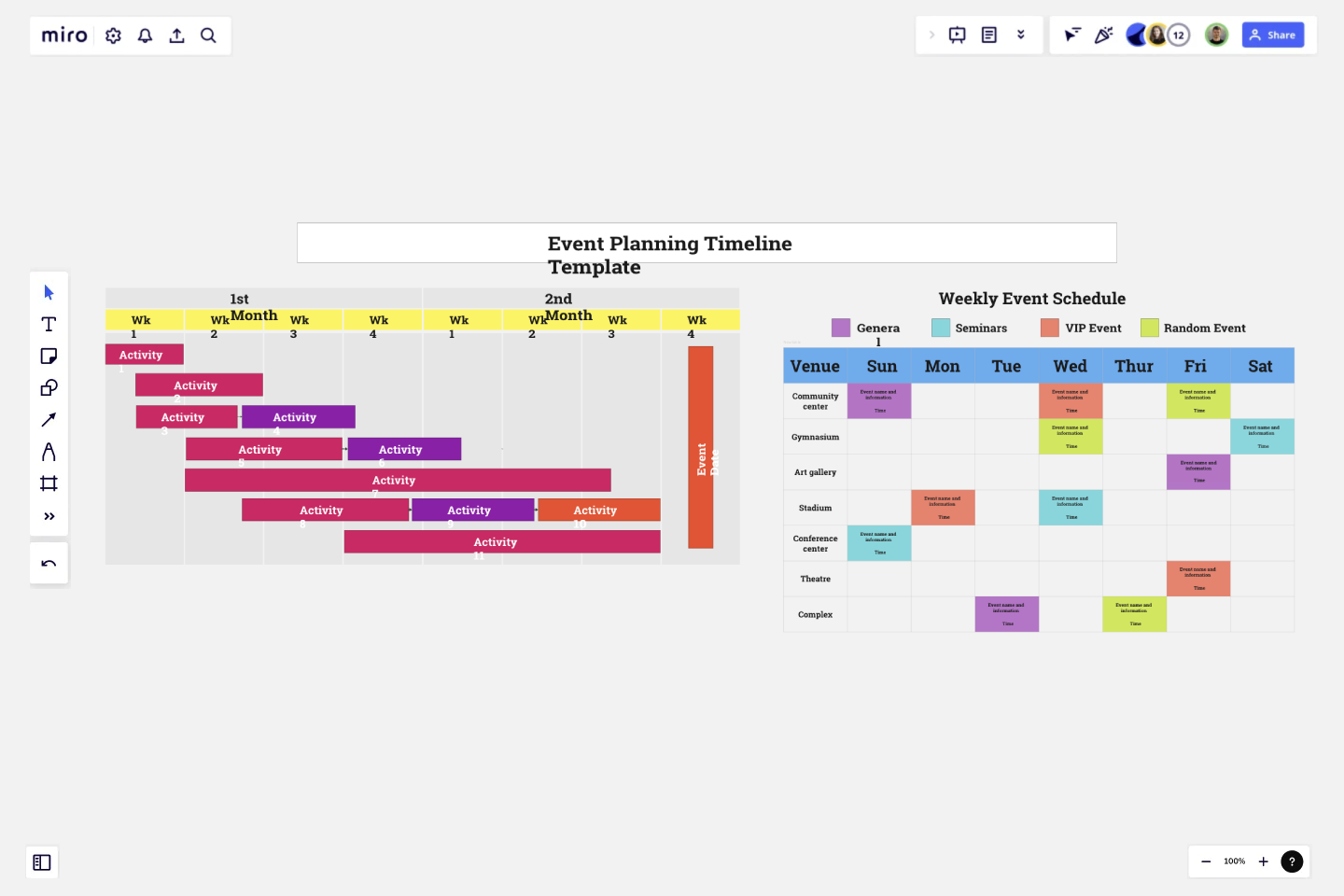

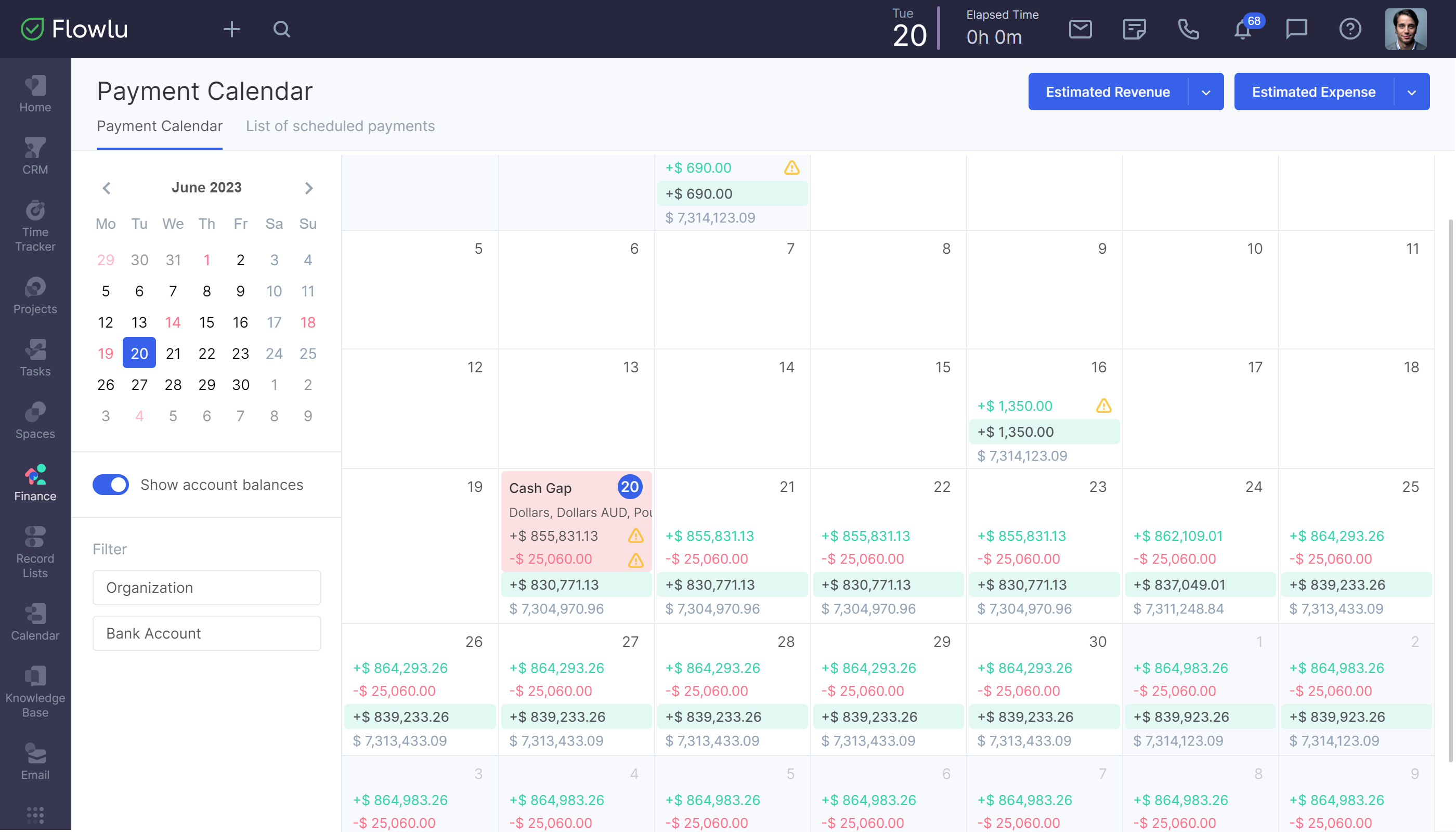

9. Plan Structured Payment Milestones

![]()

Paying randomly makes you lose track quickly. A structured payment plan keeps spending smooth and avoids panic. Many planners create this automatically, but you can do it yourself too.

- Divide payments by month

- Track deposits vs final balances

- Avoid paying full amount upfront

- Set payment reminders

- Keep receipts organized

Small trick: Sync payments with your paycheck cycle.

Why this works well: Cash flow stays stable.

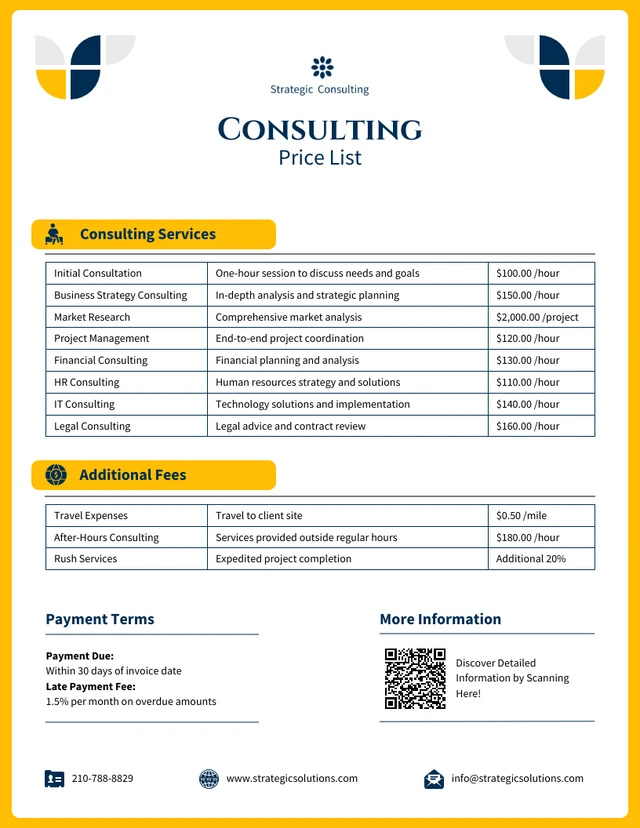

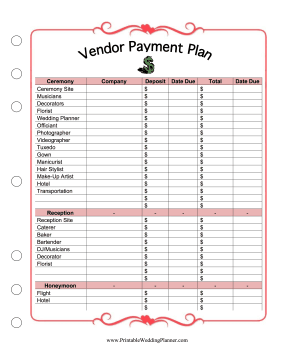

10. Track Vendor Payment Schedules

![]()

![]()

Each vendor follows a different schedule. Missing deadlines can cause penalties or cancellations. Tracking them in one place keeps everything safe and calm.

- Use one master spreadsheet

- Mark due dates clearly

- Confirm payment methods

- Keep digital copies of receipts

- Review monthly progress

Helpful tip: Add reminder alerts to your phone.

Why it’s useful: Organization prevents expensive mistakes.

11. Identify Cost-Cutting Strategies

Real savings come from smart choices, not sacrificing everything. Planners often know small adjustments that save big money without changing the overall look.

- Choose off-peak dates

- Reduce guest count slightly

- Reuse ceremony flowers at reception

- Simplify menu options

- Limit décor zones instead of whole venue

Extra idea: Focus budget on high-impact areas.

Why this strategy works: Guests remember atmosphere, not price tags.

12. Review Real Savings Case Studies

Real examples show how savings happen. One couple used a planner and avoided a venue overtime fee that would’ve cost hundreds. Another negotiated bundled photography + videography through planner contacts. Others saved by skipping unnecessary rentals after expert advice.

- Planner negotiated vendor bundle discount

- Timeline prevented overtime charges

- Guest count adjustment cut catering costs

- Rental list reduced after consultation

Short insight: Small decisions add up fast.

Why it’s convincing: Real stories show practical results.

13. Decide If Planner Fits Budget

Not every couple needs a full planner. The right decision depends on time, stress tolerance, and wedding complexity. If your event has many vendors or logistics, a planner may actually reduce overall costs. Compare this decision with your own budget breakdown to see the real impact.

- Measure time availability

- Count number of vendors

- Consider travel or destination logistics

- Think about stress levels

- Compare planner fee vs effort saved

Honest suggestion: Choose support that fits your lifestyle.

Why this makes sense: Planning style should match in real life.

14. Approve Budget Protection Plan

Before final bookings, create a budget protection plan. This means locking limits, checking contracts, and confirming backup options. A planner often guides this stage to prevent expensive surprises.

- Freeze non-essential spending

- Confirm vendor final totals

- Keep emergency buffer untouched

- Review contracts one last time

- Approve only necessary upgrades

Final pointer: Protect budget before emotions take over.

Why it truly helps: Final checks stop overspending at the finish line.

Small Details Couples Often Overlook

- Booking vendors without reading contracts

- Changing guest count too late

- Ignoring overtime charges

- Adding decor last minute

- Paying deposits without comparison

- Skipping written agreements

FAQs

Do wedding planners really save money?

Yes — if they help you avoid mistakes, negotiate vendor rates, and manage timelines efficiently. Savings come from smarter decisions, not magic discounts.

Is hiring a planner worth the cost?

It can be, especially for large or complex weddings where stress and logistics are high.

How do planners reduce vendor costs?

They often have long-term vendor relationships, bundle deals, and negotiation experience.

Can planners negotiate better contracts?

In many cases, yes. They understand common pricing traps and contract wording.

DIY vs planner savings comparison?

DIY may look cheaper but can cost more in time, stress, and last-minute fixes. A hybrid approach often gives the best result.

Conclusion

Wedding planners are not automatically money savers — but the right one can protect your budget, reduce stress, and prevent expensive mistakes. The key is knowing your budget first, understanding pricing models, and using planning help strategically. If you’re still building your overall strategy, revisit your full wedding planning approach and keep your decisions grounded in real numbers, not trends. A smart plan always saves more than a rushed one.